Unraveling the Origins and Purpose of the World’s First Cryptocurrency

In a world where money moves at the speed of light and financial systems dominate daily life, one innovation stands out as a game-changer: Bitcoin. But why was it born? What sparked the creation of this digital asset that’s now worth trillions and influences everything from investments to global economies? Dive into the story behind Bitcoin’s inception, and discover how a mysterious figure’s vision challenged the status quo, offering a blueprint for financial freedom that’s still unfolding today.

The Financial Turmoil That Set the Stage

Picture this: It’s 2008, and the global economy is crumbling. Banks are failing, governments are bailing out institutions with taxpayer money, and trust in traditional finance hits rock bottom. The subprime mortgage crisis exposes deep flaws in centralized banking—fraud, reckless lending, and a lack of transparency that leaves ordinary people footing the bill.

This chaos wasn’t just numbers on a screen; it affected millions, from homeowners losing their properties to retirees watching savings evaporate. Amid this storm, a pseudonymous individual or group known as Satoshi Nakamoto saw an opportunity for radical change. Bitcoin wasn’t created in a vacuum—it emerged as a direct response to these systemic failures, aiming to empower individuals over institutions.

Who Is Satoshi Nakamoto? The Enigmatic Creator

At the heart of Bitcoin’s story is Satoshi Nakamoto, a name that’s become synonymous with mystery and innovation. In October 2008, Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on a cryptography mailing list. This nine-page document outlined a revolutionary idea: a digital currency that operates without banks, governments, or any central authority.

Nakamoto’s identity remains one of the greatest unsolved puzzles in tech history. Speculation abounds—could it be a lone genius, a team of developers, or even an AI? Despite countless theories and investigations, no one has definitively unmasked Satoshi. What we do know is that Nakamoto mined the first Bitcoin block, known as the Genesis Block, on January 3, 2009. Embedded in that block was a headline from The Times newspaper: “Chancellor on brink of second bailout for banks.” This wasn’t random; it was a subtle jab at the very system Bitcoin sought to disrupt.

Nakamoto’s vision drew from decades of cryptographic research and the cypherpunk movement, which advocated for privacy and decentralization through technology. Influences included concepts like proof-of-work from Adam Back’s Hashcash and digital cash ideas from pioneers like David Chaum. By blending these elements, Nakamoto crafted something entirely new.

Core Reasons Behind Bitcoin’s Creation

So, why exactly was Bitcoin invented? Let’s break it down into its fundamental motivations, each addressing a pain point in traditional finance.

1. Decentralization: Power to the People

Central banks control money supply, interest rates, and transactions, often leading to inflation, censorship, and exclusion. Bitcoin flips the script with a decentralized network where no single entity holds the reins. Powered by blockchain—a distributed ledger that records every transaction transparently and immutably—Bitcoin allows peer-to-peer transfers worldwide.

Imagine sending money across borders without hefty fees or delays. That’s Bitcoin’s promise: financial sovereignty for anyone with an internet connection, free from governmental overreach or corporate gatekeepers.

2. Combating Inflation and Scarcity by Design

Fiat currencies like the dollar can be printed endlessly, eroding value over time. Bitcoin counters this with a hard cap of 21 million coins, mimicking the scarcity of gold. This “digital gold” aspect ensures that as demand grows, value could appreciate, protecting against inflationary pressures.

Nakamoto designed Bitcoin’s issuance through mining, where participants solve complex puzzles to validate transactions and earn new coins. Halving events every four years reduce the reward, slowing supply and building long-term value.

3. Privacy and Security in Transactions

In an era of data breaches and surveillance, Bitcoin offers pseudonymity. While transactions are public on the blockchain, users’ identities aren’t directly tied to addresses—unless they choose to reveal them. This appeals to those wary of Big Brother watching their finances.

Enhanced by cryptographic techniques, Bitcoin’s security model makes it resistant to fraud and double-spending, problems that plagued earlier digital currencies.

4. A Response to Financial Exclusion

Billions worldwide lack access to banking services. Bitcoin doesn’t require a bank account, ID, or credit history—just a wallet app on your phone. It democratizes finance, enabling microtransactions, remittances, and economic participation in underserved regions.

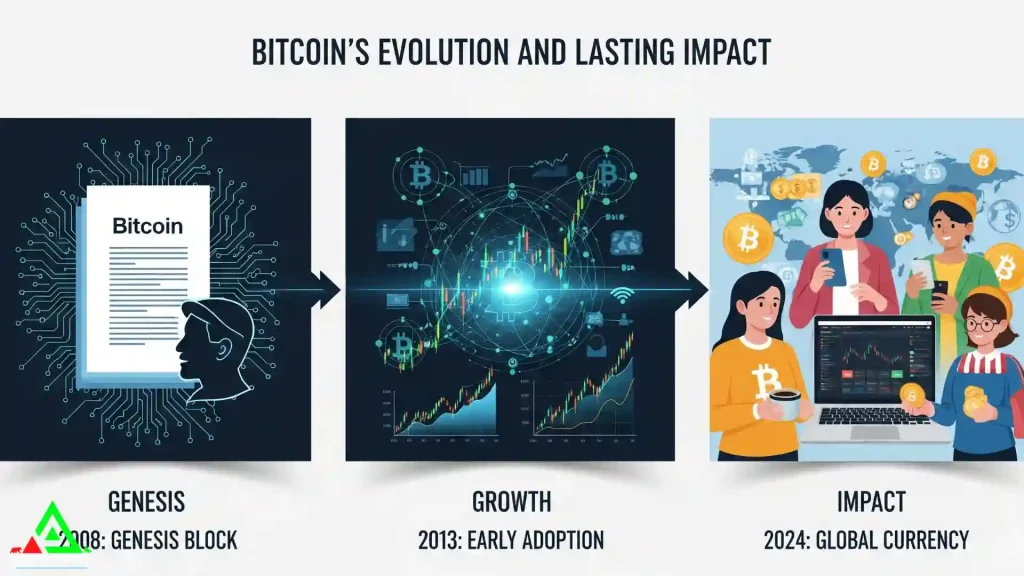

Bitcoin’s Evolution and Lasting Impact

From its humble beginnings, Bitcoin has grown into a powerhouse. The first real-world transaction? In 2010, a programmer bought two pizzas for 10,000 BTC—now worth millions. Fast forward to today, and Bitcoin fuels an entire ecosystem: from ETFs traded on Wall Street to everyday payments at coffee shops.

Its creation sparked the cryptocurrency revolution, inspiring thousands of altcoins and blockchain applications in supply chains, voting systems, and NFTs. Despite volatility and regulatory hurdles, Bitcoin’s market cap hovers in the trillions, with institutional adoption from companies like Tesla and MicroStrategy signaling mainstream acceptance.

Critics argue it’s energy-intensive or volatile, but proponents see it as a hedge against economic uncertainty. As global events like pandemics and geopolitical tensions unfold, Bitcoin’s role as a store of value continues to evolve, proving Nakamoto’s foresight.

Challenges and the Road Ahead

No innovation is without hurdles. Bitcoin faces scalability issues, environmental concerns from mining, and evolving regulations. Yet, solutions like the Lightning Network for faster transactions and shifts to renewable energy mining address these head-on.

Looking forward, Bitcoin could redefine money in a digital age. Will it replace fiat? Probably not soon, but its principles of transparency and decentralization are already influencing central bank digital currencies (CBDCs) worldwide.

Final Thoughts: Why Bitcoin Matters Now More Than Ever

Bitcoin wasn’t just created to make money—it was born to redefine it. In a world still grappling with economic inequality and institutional distrust, Nakamoto’s invention offers a beacon of hope. Whether you’re a seasoned investor or crypto-curious, understanding Bitcoin’s origins unlocks insights into our financial future.

Ready to explore more? Dive into Bitcoin’s mechanics, start a wallet, or join online communities to see its potential firsthand. The revolution started in 2008, but its story is far from over.

Who is Satoshi Nakamoto and why is their identity unknown?

Satoshi Nakamoto is the pseudonymous creator of Bitcoin. Their identity remains a mystery, which many believe was a deliberate decision to ensure Bitcoin’s decentralized nature. It also protects the creator from legal or political pressure.

What problem was Bitcoin designed to solve?

Bitcoin was designed to address the flaws of traditional financial systems. Specifically, it aimed to create a peer-to-peer electronic cash system that could operate without relying on a central authority like a bank. The goal was to provide a more secure, transparent, and censorship-resistant form of money.

How does Bitcoin prevent double-spending without a central bank?

Bitcoin uses a technology called a blockchain to solve the double-spending problem. This public, distributed ledger records every transaction, and a decentralized network of computers verifies and confirms each new block of transactions. This ensures that a single bitcoin cannot be spent more than once.

What is the significance of the genesis block and its hidden message?

The genesis block is the very first block of the Bitcoin blockchain. It contains a message referring to a headline about a bank bailout, which many interpret as a statement against the instability of traditional finance. This message highlights Bitcoin’s foundational philosophy as an alternative to the existing financial system.

How is Bitcoin different from fiat currency?

Bitcoin is a decentralized digital currency, while fiat currency is a government-issued and regulated physical currency. Unlike fiat currency, which can be printed in unlimited amounts by a central bank, Bitcoin has a fixed supply of 21 million coins. This limited supply makes it a deflationary asset.

Was Bitcoin created to be a direct competitor to traditional currencies?

While Bitcoin was designed as an alternative to traditional financial systems, its primary goal was to create a new form of digital cash. Satoshi’s vision was to establish a system that was independent of central banks and intermediaries. It was a response to the 2008 financial crisis.